Government boosts energy security through Capacity Market power auction

The government has said it is confident that electricity supplies will remain secure over the coming years, following the outcome of the latest Capacity Market auction on 9 December. To deliver a supply of secure, sustainable and affordable electricity, the UK needs investment in new generation projects and innovative technologies over the coming years. However, existing power stations must also be incentivised to continue operating. The Capacity Market aims to deal with both these issues by bringing forward new investment while maximising the capabilities of Britain’s current generating fleet.

Participants that bid at a low enough price to be successful in the auction benefit from a steady revenue stream – known as capacity payments – that encourages them to invest in new generation or to keep existing projects available on the system. These generators are then required to be available to deliver power when needed during the winter or face penalties. Households and businesses therefore benefit from enhanced security of supply. The most recent auction aimed to procure electricity capacity for four years ahead – that is, for winter 2020-21. The auction cleared at a lower cost than most commentators had forecast, meaning that business energy bills will not rise as much as some analysts had expected. Energy market researchers Cornwall forecast that the scheme will add £500 onto the average electricity bill of a small business (in 2016-17 prices).

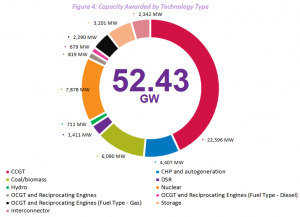

Over 52GW of capacity was procured in the auction, and a strong majority of the contracts awarded went to plants that were already operating. But the auction has also brought forward some new generation, including gas power stations in Kings Lynn and Spalding. Flexible, low-carbon battery storage has also won agreements for the first time.

Other bidders included Demand Side Response projects, which were three times more successful than in the previous auction. This includes projects in which large electricity users agree to turn down their usage during times of peak demand.

Other bidders included Demand Side Response projects, which were three times more successful than in the previous auction. This includes projects in which large electricity users agree to turn down their usage during times of peak demand.

Business and energy secretary Greg Clark said: “Our homes and businesses need an electricity supply they can rely on all year round. We’ve provided them with that certainty, at a low cost to bill payers, years in advance […]. This is about more than just keeping the lights on. A modern, reliable, and flexible electricity system powers the economy and Britain’s future success.”

Key energy decisions delayed in Autumn Statement

The government’s Autumn Statement, delivered on 23 November, failed to provide the significant energy policy announcements that had been widely expected. Chancellor Phillip Hammond confirmed that the UK’s unilateral carbon tax would, as earlier announced by his predecessor George Osborne, be capped at £18/ tonne, and uprated with inflation in 2020-21. The policy, known as Carbon Price Support, tops up the cost of the EU Emissions Trading Scheme, which requires heavy energy users to acquire permits for every unit of greenhouse gases they emit. It is intended to ensure the carbon price is sufficient to drive low-carbon investment. The government will, Hammond said, “continue to consider the appropriate mechanism for determining the carbon price in the 2020s”.

Similarly, a decision on the future of the government’s budget for low-carbon electricity schemes will not be made until the Budget next year. The Levy Control Framework (LCF) sets a cap on the cost of these schemes, which is ultimately recovered through consumers’ energy bills. The cap is currently set at £7.6bn (in 2011-12 prices) through to 2020-21. But renewables developers are keen to know the future level of the LCF as it will determine how much support they might be able to secure, while businesses are seeking clarity as it will provide an indication of the subsidies they will be required to pay for.

Hammond also said that the government remained ready to intervene in markets that were not functioning effectively for consumers – and he specifically cited energy. The government will publish its initial thinking on the issue next spring.

Lawrence Slade, chief executive of Energy UK, said: “Energy UK welcomes the chancellor’s comments reconfirming the cap on carbon price support to 2020. Predictable carbon pricing is a key element in making sure that investors in low carbon generation can plan with confidence. However, investors need to plan many years ahead and we look forward to working with government on the long term direction for carbon price support and the Levy Control Framework.”

Smart meter benefits fall in latest estimate

The average business premise is expected to achieve bill savings of approximately £128 in 2020 and £147 by 2030 through the use of smart meters, a new assessment has revealed. The government is aiming to ensure that all homes and small businesses are offered smart meters by 2020, as it is believed they will provide consumers with greater awareness of their energy usage. However, in a new “impact assessment”, the government has updated its calculations of the economic benefits of the roll-out of smart meters, and found them to be lower than had earlier been expected. The assessment, issued on 10 November, said that the benefits of installing the technology within businesses’ premises stood at approximately £2.4bn overall, while the costs totalled around £400mn.

This left the overall value of the smart meter programme for businesses at approximately £2bn by 2030.

Earlier in the month, a survey by the consumer campaign for smart meters, Smart Energy GB, suggested that business leaders remained fully supportive of the deployment of new smart technologies and recognised that they would have economic benefits.

Nearly nine in 10 (86%) business leaders told the survey they believed that the smart meter rollout was important for the British economy. A large majority (88%) of respondents said they would like to see the government put together a plan for Britain to maximise the economic potential of smart meters and other new innovative technologies. Sacha Deshmukh, chief executive of Smart Energy GB, said: “This research shows that business leaders across the country recognise the huge opportunities for innovation that are being created by the smart meter rollout and the transformation it brings to our energy system.”

Manufacturers call for greater energy policy clarity

Manufacturing trade body EEF has urged the government to re-introduce an Annual Energy Statement to provide a longer-term view of the policy framework. Its Upgrading Power report, issued on Monday 12 December, said that only one in three (33%) companies felt that the government had a long-term strategy to ensure security of supply, and very few (4%) felt that UK energy infrastructure had improved in the last two years. The report suggested that UK manufacturers were missing out on the significant savings offered by better energy efficiency. The group found that, with greater policy support, manufacturers would be able to cut 14% of current electricity consumption through the implementation of energy efficiency measures. If this potential were realised it could lead to a 12TWh reduction in annual electricity consumption – equivalent to 4% of the UK’s current annual total and some £1bn in savings.

Claire Jakobsson, head of climate and environment policy at EEF, said: “Manufacturers’ confidence in the government’s management of security of supply is tepid at best. The last eighteen months have been a high degree of uncertainty in the energy market as a result of numerous policy changes, the Brexit vote and two new administrations in a short period of time.”

Businesses call on government not to hike solar business rates

Over 160 NGOs, schools, academics, energy providers and public institutions – as well as major brands like Sainsbury’s, IKEA, and Kingfisher – have urged the government to prevent a planned rise in business rates for solar panels.

Released on Monday 5 December and co-ordinated by industry group the Solar Trade Association (STA), the letter argues that planned changes to business rates paid on solar power could see many systems become uneconomic. The changes will see rates rise up to eight-fold for organisations that own solar panels and use the power themselves. The change would mean the most efficient use of solar, consumption at point of generation, would be “bizarrely” penalised by the tax system. The tax rise is seen as most likely to hit smaller companies, who are less likely to have set up different ownership schemes for their panels, as well as public sector organisations such as state schools and hospitals.

Paul Barwell, STA chief executive, commented: “The sheer diversity of groups willing to sign this letter demonstrates the breadth of feeling on this issue. Now that the UK has signed the Paris Agreement it goes without saying that the government should support organisations seeking to reduce their carbon footprints, not penalise them. It is essential that solar energy is treated sensibly within the tax system.”

Scottish SMEs could realise significant energy savings

SMEs in Scotland waste around £19,000 on average each year that could be avoided through making energy efficiency improvements, Zero Waste Scotland has found. The organisation explained that Scottish government loans of up to £100,000 are made available to SMEs to support them in making “positive efficiency changes”. This process ensures that they save money by reducing waste and examples include installing LED lighting, better insulation and renewable technologies.

Chief executive of Zero Waste Scotland Iain Gulland said: “We know many businesses share our vision of maximising resource efficiency and keeping costly waste to a minimum, and often it’s the initial investment needed that’s the missing ingredient. The SME Loan Fund is a great way for enterprises to make optimum use of energy, water and waste under expert guidance at no extra cost – ultimately delivering savings while helping the environment.”

November sees power prices surge

Last month the contract for day-ahead peak power soared by 36.9% to average £91.5/MWh in November, the highest monthly rise since at least 2011.

Near-term baseload and peak power contracts have been largely supported by continued French nuclear supply fears – many reactors have been shut down over safety fears, impacting neighbouring energy markets.

Day-ahead baseload power jumped 16.7% to average £66.4/MWh. On Monday 7 November, the contract reached £152.0/MWh, with higher demand and lower wind generation forecast for the following day. Seasonal baseload power contracts on average decreased 2.6% in November, following their gas counterparts lower.

Also in November, day-ahead gas continued to rise, up 12.4% to average 48.4p/th. On Thursday 3 November, the contract climbed to 53.8p/th, the highest price since February 2015, as colder temperatures and a bleak LNG outlook supported prices.

Seasonal gas prices slipped 1.6% on average, with a decline in oil prices. Summer 19 gas experienced the largest fall – of 3.3% to 42.0p/th. In contrast, the summer 17 contract moved 0.6% higher to 42.8p/th. At the end of November, Centrica announced that the Rough gas storage site will be available for gas withdrawals no later than from 9 December – meaning more supplies during winter, even though the site is only 35% full at present.

Oil prices hit a one-month high as OPEC agreed its first output cut since 2008. The deal also included the group’s first coordinated action with non-OPEC member Russia in 15 years. This saw prices hit a one-month high of $50.1/bl on the day of the meeting. Brent crude oil prices have continued to rise, gaining 8.6% on the week ending 9 December to average $54.3/bl.

API 2 coal went up 5.2% to average $70.3/t. In November, China announced a relaxation of restrictions on domestic coal production. This has started to limit import demand there and is set to slacken global supply. Meanwhile, the EU’s carbon price – EU ETS carbon – lost 0.3% to average €5.6/t during the month. On Wednesday 30 November, prices fell to a two-month low of €4.52/t.

Look-ahead: Cold weather

There is an “increasing likelihood” of a colder and less windy than normal end to the year across northwest Europe, according to analyst Marex Spectron’s meteorology desk. The chances that these conditions may spill over into the New Year have also increased. This would create higher gas and power demand, amid already tight capacity margins and French nuclear outages.